Opinion

Why Are Adani Entities Applying For Settlement In Response To SEBI’s Show Cause Notice? How Many Free Passes Will Adani Get?

Published

8 months agoon

Breaking news from the financial corridors of India has sparked a familiar yet unsettling question – How does the Adani Group continue to secure what seems like an endless string of free passes?

Here’s a small note before we move ahead – (Hindenburg’s allegations included complex offshore entities allegedly used by the Adani Group to inflate stock prices and circumvent regulatory norms. SEBI’s ongoing investigation into minimum public shareholding violations seems like a direct offshoot of this broader context, adding credibility to the accusations of opaque financial dealings.)

This time, the controversy revolves around several Adani-linked entities applying for settlements with the Securities and Exchange Board of India (SEBI). These applications come in response to a show cause notice issued on September 27, alleging violations of public shareholding norms across four of Adani’s listed companies.

The Crux of the Issue

SEBI’s investigation alleges that Adani Group engaged in unfair practices by misclassifying promoter shareholdings as public shareholdings, thus violating India’s stringent public shareholding norms.

This is a serious allegation!

The four companies under scrutiny—Adani Enterprises, Adani Power, Adani Ports and Special Economic Zone, and Adani Energy Solutions (formerly Adani Transmission)—acknowledged receiving the notices in their Q2 FY25 reports. The alleged wrongful gains exceed ₹2,500 crore, reportedly accumulated through complex shareholding structures orchestrated by Vinod Adani, Gautam Adani’s elder brother.

While SEBI’s investigation has been ongoing, the settlement offers have raised eyebrows. Emerging India Focus Funds (EIFF), a Mauritius-based foreign portfolio investor linked to Vinod Adani, has proposed a settlement of ₹28 lakh.

Additionally, Vinay Prakash, director of Adani Enterprises, and Ameet Desai, director of Ambuja Cements, have each offered ₹3 lakh as settlement amounts. Adani Enterprises itself has also sought to settle the case.

What Does a Settlement Really Mean?

Let’s address the elephant in the room – settlements do not imply guilt. In fact, filing a settlement application is a procedural right that any corporate entity served with a show cause notice can exercise within 60 days.

According to a source close to the developments, “This is a precautionary measure to buy peace, without admitting or denying the charges.” However, to the public eye, it raises a different question- If there’s nothing to hide, why not let the investigation run its course?

A Pattern of Controversy

This is not the first time the Adani Group has found itself at the center of regulatory storms. Past accusations of opaque corporate governance and questionable offshore links have already fueled skepticism about the conglomerate’s practices.

In this case, SEBI’s notices have gone beyond just corporate entities—they have been issued to 26 individuals, including Gautam Adani, his brothers Vinod, Rajesh, and Vasant, nephew Pranav Adani, and even their long-time auditor Dharmesh Parikh.

Notably, Adani Green Energy managing director Vineet Jain, who was recently charged by U.S. authorities for securities and wire fraud, is also implicated. The widening net of accusations suggests that this isn’t a one-off regulatory hiccup but a symptom of systemic issues within the conglomerate.

)

Why Are Free Passes Perceived?

The perception of “free passes” stems from repeated controversies involving the Adani Group that appear to conclude without significant repercussions. Critics argue that such leniency could undermine the integrity of regulatory frameworks, particularly if high-profile corporations can settle potentially serious allegations with relatively minor penalties.

For instance, ₹28 lakh from a foreign portfolio investor and ₹3 lakh from corporate directors seem negligible compared to the alleged ₹2,500 crore in wrongful gains.

The Adani Group, SEBI, and the Shadow of Non-Compliance

The ongoing investigation into the Adani Group’s alleged non-compliance with public shareholding norms isn’t a recent phenomenon—it dates back to June-July 2020.

Back then, SEBI received complaints about potential breaches of the minimum public shareholding (MPS) requirement, a rule crucial for maintaining transparency, liquidity, and fairness in the stock market. For listed companies in India, this rule mandates at least 25% public shareholding to ensure that a meaningful chunk of equity remains in the hands of public investors.

SEBI formally launched its inquiry on October 23, 2020, scrutinizing transactions between September 1, 2012, and September 30, 2020. The outcome of this investigation is now central to the controversy swirling around the Adani Group.

Complex Transactions Of FPIs And Offshore Entities

According to SEBI’s show cause notice, the investigation uncovered an intricate scheme involving two foreign portfolio investors (FPIs)—Emerging India Focus Funds (EIFF) and EM Resurgent Fund (EMR)—as well as a foreign investor, Opal Investments.

These entities were allegedly connected to Adani Group promoters, particularly Vinod Adani, Gautam Adani’s elder brother. Their collective goal? To artificially bolster the public shareholding in four key Adani companies—Adani Enterprises, Adani Power, Adani Ports and Special Economic Zone, and Adani Energy Solutions (formerly Adani Transmission)—to meet regulatory norms.

Here’s how it worked:

–Adani Enterprises shares were acquired during an offer-for-sale (OFS).

–Adani Ports shares were bought through an institutional placement program (IPP).

–Adani Power shares were gained through a merger.

–Adani Energy Solutions shares were also acquired by these foreign investors.

Before these transactions, public shareholding in Adani Enterprises and Adani Ports stood at 20% and 23%, respectively. After the OFS and IPP, public shareholding, including shares held by EIFF and EMR, conveniently rose to the regulatory threshold of 25%.

Following the Money Trail

SEBI’s investigation identified a common shareholder among EIFF and EMR: Global Opportunities Fund (GOF), a Bermuda-based entity. The trail gets murkier from here, with GOF’s shareholders linked to various offshore entities:

–Mid East Ocean Trade & Investment (Mauritius)

–Lingo Investments (now Southeast Citrine Trade & Investment)

–Gulf Asia Trade & Investment

–Gulf Arij Trading

Interestingly, all four received funding from Nasser Ali Shaban Ahli, a UAE national with deep financial and business ties to Vinod Adani. The connections didn’t stop there—Chang Chung-Ling, a Taiwanese national with a history of association with Adani-linked firms, served as a director across these entities, while Tejal Ramanlal Desai, an Adani Group employee, wielded power of attorney.

Adding another layer of intrigue, Excel, a UAE-based investment advisory firm, was involved in making decisions for GOF. SEBI’s notice stated that Excel was a wholly-owned subsidiary of Assent Trade & Investment, controlled by Vinod Adani’s Asankhya Resources Family Trust. In essence, while Ahli provided the funds, Vinod Adani, through Excel, appeared to control the investment decisions.

The Voting Pattern. A Red Flag

SEBI also observed a peculiar voting pattern. Unlike typical FPIs that vote independently, EIFF and EMR consistently voted in alignment with the Adani promoters on critical issues—whether it was the approval of related party transactions, reappointment of promoter-directors, or financial approvals.

This unusual alignment, coupled with Excel’s advisory role, signaled that Vinod Adani exerted control over the FPIs’ shareholding rights, contradicting the classification of their holdings as “public.”

Massive Recovery Sought

The fallout of SEBI’s findings is significant. The regulator has sought to recover a staggering ₹1,984 crore from nine key individuals, including Vinod Adani, Nasser Ali Shaban Ahli, and Chang Chung-Ling. Additionally, ₹601 crore is being pursued from five others, including Pranav Vora and Dharmesh Parikh.

Now that we have explored the latest case there is yet another angle that needs to understood.

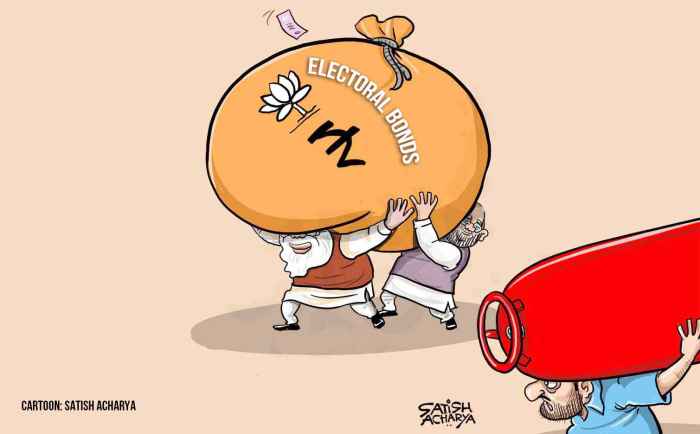

Adani, Hindenburg, And Electoral Bonds. Legalization of Bribes or Just Business as Usual?

The recent wave of controversies surrounding the Adani Group has again pulled out serious questions over India’s corporate governance and political transparency.

The Adani Group’s response to SEBI’s show-cause notice on non-compliance with public shareholding norms might seem like a legal procedural move, but when viewed in the broader context of recent scandals, including the Hindenburg Research report and U.S. indictments, a larger, more unsettling picture emerges.

This brings us to a critical question – Are India’s corporate scandals linked to a system that allows political contributions under the guise of electoral bonds, potentially legalizing bribes?

Hindenburg’s Bombshell and the Aftershocks

In early 2023, the Hindenburg Research report sent shockwaves through the Indian stock market, accusing the Adani Group of stock manipulation and accounting fraud. While the conglomerate dismissed the allegations as baseless and a “calculated attack on India,” the report brought unprecedented global scrutiny to Adani’s financial practices, governance, and political ties.

This wasn’t just a corporate scandal—it was a wake-up call about the intertwining of corporate power and political influence in India.

Hindenburg’s allegations included complex offshore entities allegedly used by the Adani Group to inflate stock prices and circumvent regulatory norms.

SEBI’s ongoing investigation into minimum public shareholding violations seems like a direct offshoot of this broader angle, adding credibility to the accusations of opaque financial dealings.

The U.S. Indictments.

Further complicating matters, Vneet Jaain, managing director of Adani Green Energy, was recently charged by U.S. authorities with securities and wire fraud. Although this case pertains to different allegations, it fuels the perception that Adani-linked entities are operating on shaky ethical ground across international jurisdictions.

The global implications are clear – when large Indian conglomerates are accused of fraud on such a scale, it not only dents their credibility but also raises concerns about India’s regulatory environment and political integrity.

Electoral Bonds. A Transparent Cover for Opaque Deals?

In this context, India’s electoral bond scheme—introduced in 2018—deserves scrutiny. Designed as an anonymous instrument for funding political parties, electoral bonds have often been criticized for lacking transparency and accountability.

The bonds allow individuals, corporations, and even foreign entities to donate unlimited sums of money to political parties without disclosing their identity.

Critics argue that this effectively legalizes political contributions that could otherwise be considered bribes, especially when large corporations with significant government contracts and regulatory challenges are involved.

The Adani Group’s closeness to the political establishment, particularly the current ruling party, raises questions about whether such bonds have been used to funnel money in exchange for favorable treatment.

The timing of Adani’s alleged regulatory violations and the political contributions made through electoral bonds cannot be ignored. Could these financial instruments be serving as a legalized conduit for corporate-political collusion?

The Thin Line Between Influence and Control

If conglomerates like Adani wield disproportionate influence through anonymous political funding, are we witnessing a subtle erosion of democracy where corporate power dictates political outcomes?

This scenario raises deeper concerns about governance in India:

- Are regulatory bodies truly independent, or are they compromised by political pressures?

- Is corporate accountability being diluted through systemic loopholes like electoral bonds?

Reform or Regress?

The convergence of Adani’s legal troubles, Hindenburg’s damning report, the U.S. indictments, and the lack of transparency in electoral bonds paints a worrying picture of corporate governance in India.

While electoral bonds were intended to clean up political funding, they appear to have enabled large corporations to exert undue influence over the political system, blurring the lines between legitimate contributions and corruption.

India must confront these issues head-on. Regulatory reforms, transparency in political funding, and stringent corporate governance norms are essential to restoring faith in the system. Without these, the perception of legalized bribery through mechanisms like electoral bonds will persist, undermining both India’s democratic institutions and its global economic credibility.

Huge Implications

Again, this case isn’t just about financial penalties or regulatory compliance—it’s about the integrity of India’s capital markets. If these entities are found guilty of artificially inflating public shareholding, it undermines investor confidence and raises questions about the effectiveness of regulatory oversight in preventing manipulation by powerful conglomerates.

SEBI’s investigation has laid bare a sophisticated structure allegedly designed to circumvent rules, and the forthcoming decision could set a precedent. Will SEBI stand firm and enforce accountability, or will this be perceived as yet another “free pass” for a corporate behemoth with deep roots in India’s economic framework?

The Last Bit

SEBI is yet to decide on the settlement applications, and the outcome will be pivotal. If SEBI accepts these settlements, it may set a precedent—either a welcome one for corporates looking for legal closure or a dangerous one if perceived as leniency towards large conglomerates.

However, rejecting these settlements could signal a shift towards stricter regulatory enforcement, which would send a strong message across the Indian corporate sector and a welcome one.

This isn’t just about settlements or fines—it’s about the credibility of India’s markets and the message sent to investors, both domestic and global. How many more “free passes” can one conglomerate receive before the system says enough?

You may like

-

Adani $265 Million Bribery Scandal Comes Under Spotlight Again. US SEC Seeks India’s Help, Stocks Trade Mixed—Modi’s Dilemma, Protect Or Distance?

-

Lenskart IPO, Plans To Generate $1 Billion, Likely To Approach SEBI In May—What’s The Buzz Around This Upcoming Offering?

-

Adani’s US Indictment Case, The Fight Back Begins With Top-Notch US Law Firms. With Hindenburg’s Fall, Was Adani An Easy Target?

-

Justice Or Pressure? Hindenburg, The King That Toppled Adani’s Empire, Calls It Quits—What’s The Deal And Look Whose Having The Last Laugh.

-

The Great Haul, IPO Run To Gallop In 2025 As 80+ Companies Await SEBI Nod

-

Has the World Entered Neo-Feudal Capitalist Times? Could Musk, Trump, and India’s Modi Be Symptomatic of This Era?